*Dramatic movie trailer music*

Deep Voiced Announcer: In a world where money has been called the root of all evil… one brave soul is charged to step up to the money monster, sword in hand to slay the pocket dragon.

*Really cool graphics and effects of dragons with glistening ruby eyes and Jeffersons ($2 bills) for scales, gnashing their teeth and blowing out their treacherous fire breath.*

Deep Voiced Announcer: Our (S)Hero is gallant with her/his sword, but it appears as though the dragon is winning. That fire breath is scary… and hot. But our (S)Hero won’t be stopped by hot breath. S/he knows that this dragon is only treacherous because it’s misunderstood. S/he knows that s/he sees the dragon as a danger because s/he hasn’t yet learned that this so-called monster is actually a tool for something greater– for her/his life and the planet. How, you ask? Well you have to watch the movie It’s Not A Budget, It’s “Money Management” to find out.

*The words ‘COMING TO A BANK ACCOUNT REVIEW NEAR YOU’ appear on the screen as you sit in the movie theatre with your mouth agape*

Movie goer(to the empty seat next to her): Deeeen. That jawn looks scary as all get out! I think I wanna see that when it comes out tho.

Man look. You laughing like– Envy is so crazy– but that is exactly how I feel every. single. time. I sit down to face my money. I’ve tried all kinds of ways of money management:

- praying

- blatant avoidance

- spend fasts

- spend detoxes

- down sizing

- up sizing

- The Secret

- wishful thinking

- lottery tickets

- books

- wealth affirmations

- guilt

- money shaming

- rich people hating

- rich people loving

- praying

- wanna be budgeting

- yoga

- some more praying

- other random stuff

I know I’m the only one. Right? Yeah.

I know people who for all intents and purposes are RICH and always “broke” come months end. I know others that say out loud, I don’t make enough money to manage–My bills are all the money management I need. I know some other folk that are so exasperated with money, they don’t know whether to celebrate it or give it the finger when they have it. I know some folk who just like to pretend that money is the devil and the less they need/have to survive, the better. I know some people who spend. every. last. dime. on. everything. OTHER. than. their. bills.– just to be impressive to people who are doing the exact same thing. I know some people who are diligent (read responsible) with their money and miserable. I know some people who have a team of people to handle their money and couldn’t tell you their bank account balance on a bet. I know people who are always stressed the fock out about their money. Like, always. I know some people who literally got their degree in money (accounting) but have little sustainable wealth, let alone an emergency fund. I know some people who have so much debt, they tell me they feel like they collect a salary just to maintain it. I hear tons of stories about people who literally have 2 weeks more month than money.

To be fair, I also know people who are brilliantly happy, have plenty of money, have fun with it, are generous, kind, creative, own stuff, invest in stuff, live their lives the way they want and have ZERO oppression issues when their bills come around. Some of these folk would be considered Super Rich and some would be deemed not poor, but all of these people have a brilliant, healthy relationship with money and I love it. I will also say with some amount of emphasis, I am not presently one of those people. Just this week I had to do “the dance” about checking my account balance. I mean seriously. My palms got sweaty, my heart rate went to a thrillion. Michael Jackson’s Thriller was playing in my head and I couldn’t tell if I was Ola Ray or Michael in zombie face.

For the most part, I’m not working with sooooo much that I don’t know how much is in my account at any given point, but it’s like I see money as this fickle traveler who shows up when she likes and doesn’t stay long cause she has more important things to do than just be chillin in my account, so I can have some peace of mind. I used to cuss her. Like, CUSS when she left for the contrillionth time. But I’m starting to learn that if I want her to want to chill with me, I’m going to have to figure out what my primary malfunction is. Cause honestly, it’s not her. It really is me.

I can’t buy into the whole ‘mo money, mo problems’ spiel because I’m not rocked out (yet) like Diddy is. But I am interested in being more powerful with the money I have. You? So as I mentioned, earlier this week I caught myself doing “the dance” about checking my account balance. I went back and forth about it for some time. “I know what’s in there”, I reasoned. “I don’t have to look at it to know what it is…” But the truth was, I had my suspicions, but I truly didn’t know. I was afraid to look because I felt guilty. I was positive I overspent somewhere, and there was nothing I could do about it. So blatant avoidance was best for my ego. My attitude was– if I can’t see the damage, well then we can pretend I’m still awesome, right? But then I remembered this vid I saw a few weeks ago with Marie Forleo and author Kate Northrup called 4 Money Beliefs Keeping You Broke:

One very poignant suggestion Kate made in the above video was to look at your bank balance every single day. The idea is to connect with your money and to always be on top of what your account looks like. That way you can catch errors or fraud more quickly and you also establish a fearlessness that your account isn’t actual Goliath and you don’t actually need a pebble and a sling shot to be in full control of your finances. All you have to be is present. Daily. It sounds easy. Welp.

Meanwhile, I was still doing “the dance”. And for the life of me, I can’t tell you why. I didn’t have anything to be scared about. It’s not like I bought a Bentley on my ATM card. Yeezus. But I just have this strange and irrational fear that what I have isn’t enough–even when it’s more than enough. So instead of being stressed about it, I avoid looking. The concept is so ridiculous, it makes wackadoodles and Voldemorts seem almost sane. It was then that I realized that I was so sick of that sick feeling I had from something so draining like being scared to check my account balance, that in a rage of protest I checked the darned thing. Lo and behold, while I feared fire and brimstone, there were crickets chirping instead. Womp. But because I had finally motivated myself to get to the bottom of my “it’s complicated” relationship with money; and most importantly–the money in my bank account– I was also ready to revisit this concept of divine money management.

Thank goodness I’m also revisiting my short lived communion with A Course in Miracles. That particular day, I was on Lesson 5 of the Student Workbook which states:

I am never upset for the reason I think

Well. Yeah. From there, I was exposed. Turns out the lesson for the very next day was:

I am upset because I see something that is not there.

Of course, I didn’t know that at the time, but we get it that hindsight is 20/20 yes? K. So once I gathered my ovum, I decided right then that I was done being terrorized by my own mental fuckery. I was going to have a more loving relationship with my cash, even when it doesn’t seem like enough worth loving. In order to do that I would have to change my narrative. I would have to reframe the conversation that I keep having with myself and prolly… I was going to have to *gasp* use a budget. BUT. And this is a really big caveat– my determination is to build my wealth, whilst having FUN on the road to financial freedom. But in order to see my money-loving-airy-fairy-froufrou-money-utopia vision to fruition, I would need a plan.

Because the universe is so abundant, there are brilliant people everywhere who have already mastered some of the personal development qualities you may be working on. I can’t think of anything that doesn’t at least have a YouTube tutorial. I mean. I’ve seen a time lapse video on growing a mango tree. In a small pot. So. There are tons of people who have trained and/or upleveled something in their lives already. So for every challenge, there is a viable, life giving , freedom finding solution. Somewhere. Everything taint for everybody, but at least you know you have options for your unique goals. If you want to be a superhero and/or you have #RuleYoSelf spiritual literacy goals, I’m your gal. If you want sassy but insightful modern entrepreneurial advice, Marie Forleo will set you on path. If you want to create goals with soul, OMG you’ll love Danielle LaPort. If you want to to learn practical ways to pay off your student loans starting now, I would call Dave Ramsey.

Because I want to feel more joy every time I look at my checking account, I have to learn how to stay in my money’s face and really express gratitude for what is there. Everybody has their ideas of what a lot and a little is, so I’m not going to go there.

I know I’m good at paying my bills and maintaining my necessities without being cheap about it, but I’m not so good with feeling like I have enough to do anything else after. It’s such a strange dichotomy to be as spiritually abundant, creative and free as I am and have this one sector of my life feel like Ricker’s Island. Plus, being good at money relationships is often paralleled with being good at budgeting. Mention the word “budget” to me in a sentence and a natural gag reflex happens.

That’s when spirit whispered, “it’s not budgeting love, it’s money management”. Whet? So my response was, “But I don’t have enough of it to be all ‘money managing’ it. I already know exactly where my money goes.” So spirit was like, “but do you know where it COULD go, if you changed your narrative about it?” *cough*

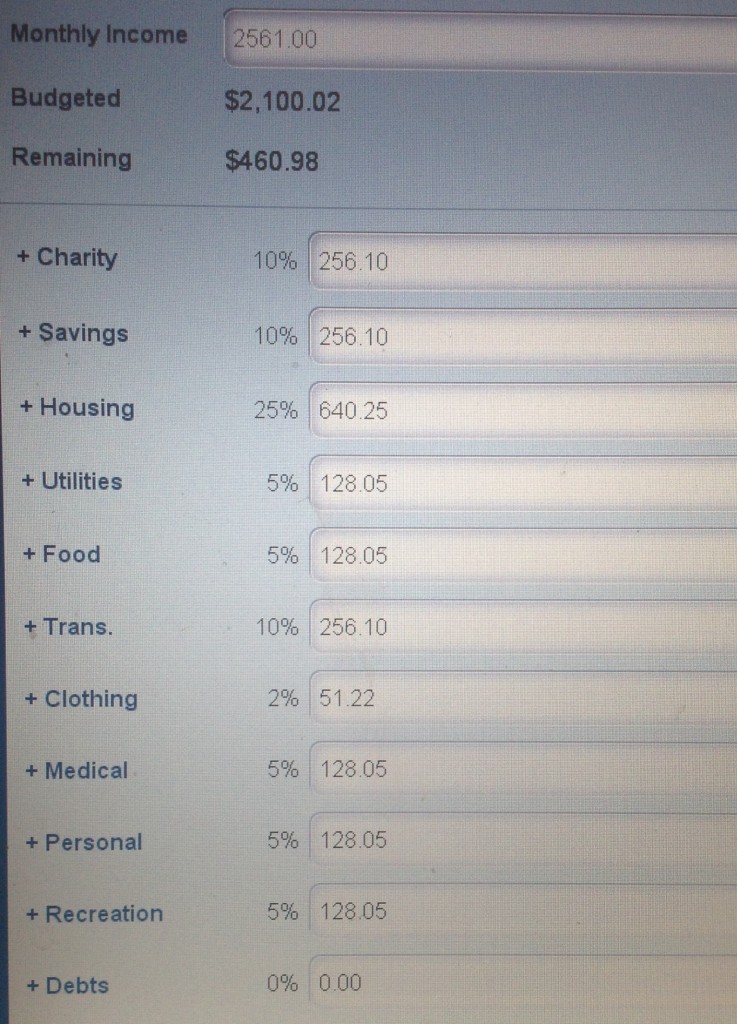

I hate it when spirit is right. Like always. You would think I’d stop arguing by now. But, no. So anyway, I was led to revisit DaveRamsey’s site, as I have so many dozens of times before and fill in his dreaded budget calculator. I recommend this step for everybody, even if you already have a budget. You’ll see why in a minute. Because I work for myself, my monthly income fluctuates and the cool part is that since money management is an everyday process, you can change your budget based on what you know you’ll be working with anytime you need to. It’s super easy, all you do is fill in your monthly income and a ready made budget pops out. It was so easy it was actually lazy. For the purposes of this conversation and to show how the percentages work, even if you don’t think you’re working with much, I used the average monthly income for Black Americans (before taxes) according to CNN Money.

“My Budget”

——————————

Income: 2561.00

Budgeted: 2100.02

Remaining: 460.98

——————————

Charity: 256.10 (10%)

Saving: 256.10 (10%)

Housing: 640.25 (25%)

Utilities: 128.05 (5%)

Food: 128.05 (5%)

Transportation: 256.10 (10%)

Clothing: 51.22 (2%)

Medical / Health: 128.05 (5%)

Personal: 128.05 (5%)

Recreation: 128.05 (5%)

Debts: 0.00 (0%)

You can adjust hard numbers to what you’re working with now right there on the output on Dave’s site and the percentages change automatically. For me, it was cool to see what the recommended ideal percentages for income versus output.The whole idea with Dave’s plan to financial freedom is to get oneself out of debt, build a viable savings account without sacrificing having fun with your money too. Plus, actually learn how to rock out within the means of the income you have, so you can invest in things that will generate actual wealth, without accruing more debt. As you can see with the above budget example, even giving back/tithing and fun stuff is included. Plus, as I discovered, you’ll be surprised that even when money seems extra tight, how much room you actually have to do stuff you want to do and need to do with some dignity.

I am by no means saying that adopting a budget will free you completely from whatever money woes you have, but I am saying taking actionable steps to manage your money (daily) in the direction toward what you actually want, feels a lot like I hope freedom does feel. When I realized what I was actually spending, where it was going and how far off it was from the above budget, I was vigilantly inspired to make immediate changes. The first thing I did was save myself $90 on my $235 monthly phone bill, simply by changing my data plan. You would think I would have to sacrifice the data I needed to work effectively with my smart phone in order to tuck my spending in, but it turns out I actually have so much more data than I will ever use, while paying less. It’s actually crazy. Plus, it frees up $90 to put somewhere else in my budget. Which, we’ll suppose is the whole point of upleveling our conversations with our money–to do more with what we have, so we can do even more when we have more, yes?

If there is anything I’ve learned so far by facing my money is that my fear is completely unfounded. It’s bullshit. I am actually in control of my current situation. I may not be able to dictate tomorrow, nor can I fix yesterday, but I can do what I can right now. If I feel constricted by my cash, it’s because I’m not L.O.V.E.ing it properly. Fear of a thing, sets up the attack of it. From a spirit sense perspective, money don’t go places it don’t feel loved. IJS. Just like any LOVEing relationship, a good thing together requires daily interaction, appreciation for what you have and conscious, honest communication. It turns out, to train the money dragon from a horror flick to a L.O.V.E. story, only requires reframing the conversations we keep having with ourselves. And then some dancing. Not with checking our bank accounts tho (unless you just wanna)… in the direction of our dreams.

Osho Lovianhal (Light the Love in ALL) friends,

-e-

Question for you:

What do you most want to change about your relationship with money? What could you teach someone else about having a great relationship with money through your current life example? If your relationship with money is a bit strained and needs some work, what are you willing to do to have a great L.O.V.E.life with your current cash?